While I will be mainly looking at the funding rate for Ethereum on Binance, as that is the futures product that I use, most of what I say will apply to other coins like bitcoin and to other exchanges like Bitmex.

Also when I talk about returns I am talking about the returns received if you are shorting the contract, if you are long you will be losing the same annualized percentage you see in the charts. I got the numbers for these returns by extrapolating out from a rolling average of 3 days of funding rates.

History of funding rate

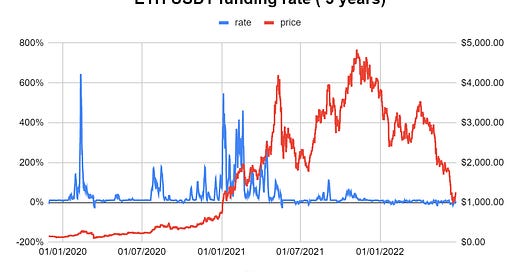

Above is a graph of the last two and a half years of the return for shorts in the ETH/USDT futures (Left axis) and the price of Ethereum (right axis).

As we can see the return from shorting has fallen a lot in the last year. If we zoom in we can see that it is still positive, with an actual return over the last year of about 10%.

Another thing to note is that while the funding rate is high the market tends to be in a bull market and while the rate is low, to be in a bear market. If you are interested in learning more about this connection check out this article by BitMEX and this paper by Sai Srikar Nimmagadda.

Funding Mean Reversions 2018

BITMEX FUNDING RATE CORRELATION WITH BITCOIN EXCHANGE RATE

The two things that affect the funding rate

In a futures contract, some people want to short and some want to go long. These two sides are matched off when making a trade. As you need both sides to make a trade, a problem arises when more want to go long than those that want to go short. This causes the price of the contract to go above the spot price.

One of the functions of the funding rate is to bring this contract price back in line with the real price of Ethereum (Spot price). It does this by paying one side or the other, extra, this happens on binance every 8 hours. So if there is too much money looking to go long, thereby rising the price above spot, the funding rate will start to pay shorts.

The other reason for the funding rate is the cost of borrowing each of the assets invovled. Take going long on ETH/USDT, this trade is like borrowing USDT to buy ETH, if you were to do this on spot markets you would have a cost of the borrowing of USDT and after you could lend out the ETH. In a rational market, the funding rate would take into account this difference in borrowing rates. Let’s say the borrowing rate for USDT is 10% and the borrowing rate for ETH is 5%, you would expect the funding rate to go long on ETH/USDT to be 5% minus 10%, so minus 5%. Or to go short plus 5%.

These two mechanisms combine to get us the funding rate we see. It is my opinion that the first cause, the balance of longs and shorts, is the main driver.

What has changed in the last year

I hope so far I have stuck to facts. At this point, I will need to move into speculation.

We just learned that, more people going long can cause the funding rate to go up, so one thing that could explain the fall in funding fees is fewer people going long.

In July last year, around the time the funding rate noticeable contracted, Binance changed there leverage policy.

Instead of being able to go long 125x it would now only be possible to go long 20x. While this change would also affect those going short, it is my guess that more were using leverage to go long than to go short.

With the removal of the leverage more longs left than shorts and that has compressed the funding rate. Also as the leverage is unlikely to be raised again I do not think we will see the return to the 100% returns we were seeing in years gone. Mind you 20x leverage is still enough to kept the long/short ratio out of balance so I think we can see returns above 10% in bull markets. Only time will tell.

There is at least some evidence for this leverage theory, my other idea for what has collasped the funding rate is pure spectulation.

The only other thing that I can think of that could have stableised the funding rates, is a large organisation or organisations that likely saw how much money could be made by the simple arbitage (arb) trade of shorting the futures and buying spot. This trade adds shorts to the futures, thereby reducing the long/short imbalance and reducing the funding rate. I have wondered for years why large funds have not come in on this arb trade, maybe last summer they did.

If I am right, what did all this money coming into the futures contracts do to the price of crypto? Likely nothing, as to arb the high funding fees people needed to go long on spot and short on futures at the same time, so it should have been neutral to the market as a whole. Equally, if they decided to pull out of the trade, their exit should also be neutral to the market.

With returns dipping negative it is possible that the money that came in to arb the funding fee may decide to leave. Although there have been many occasions in the last year that the returns went negative and then didn’t abandon the arb.

Personally, my guess is that funding rates are unlikely to rise to the crazy highs we saw in previous years. Both due to lack of leverage and due to large funds willing to arb the funding fee. While this is not great for the returns for this arb trade it is great news for people going long on the futures as they are unlikely to be paying over 1% in fees in just 1 week, which happened regularly in the past.

Do you agree? I’d love to hear your thoughts on the funding fees and what has caused their reduction.

This is my first attempt at writing a newsletter so feel free to give me any other feedback too. Also here is a link to my youtube channel, currently I am just doing videos on cryptocurrency but I will be adding videos about my general investing activities soon, like stocks and property.